src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

Americans tend to be a somewhat self-absorbed group when it comes to international affairs. As a herd, we were dumb enough to believe the "War on Terror" was legitimate, just as we (as a herd) accepted the "War on Drugs." Put in an appropriate world-view context, there can be no doubt that both of these issues were simply ways to enrich the few at the expense of the many (i.e. redistribute wealth to those who need it least) and curtail individual liberty. Many in the U.S. actually still believe that terrorist bogeymen justify ignoring our constitution, suspending all personal freedoms and invading defenseless third-world countries to stamp out "terror" (all the while happy to ignore the fact that the United States is now the country engaged in terrorism).

Anyhoo, to bring things back to economics and investing, people in America are often happy to assume that we are totally screwed economically and ignore the fact that most other global economies are also screwed. In fact, some other economies may be screwed much more than we are. This global economic depression that has only just begun will not spare any major country. When it comes to an investment standpoint, in fact, other countries may actually have worse stock bear markets in nominal terms. This is also why I'm not as much of a U.S. Dollar bear as most Gold bulls are. I think Gold will rise relative to all intrinsically worthless fiat currencies and the fluctuations between such paper instruments are only of mild academic interest to me.

The secular stock bear market that the United States has been in since the year 2000 is not over by a long shot. While I was personally much too bearish this summer in seeking a resumption of the general stock bear market, I am certainly not willing to admit defeat on my global investment thesis: Gold good, stocks bad. The current general stock market rally has stretched further in time and price than I thought was possible, but that doesn't mean it is anything more than a rally within the context of a secular bear market.

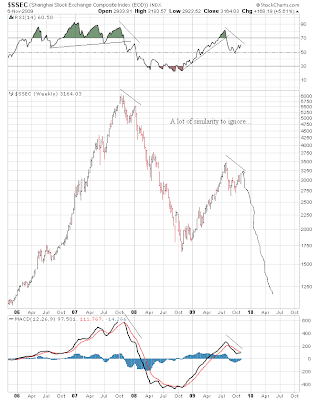

The next leg down is already being telegraphed by some Asian markets in my opinion. Here's a 4 year weekly chart of the Shanghai Composite ($SSEC):

And here's the Japanese Nikkei Index ($NIKK) over the past 4 years using a weekly candlestick chart:

If "feels" as though these stock charts have already broken down. While there are no guarantees when investing/speculating, I think the Asian markets may well lead the next leg of the bear market down. These markets may actually create greater speculative profits for those into shorting markets than the U.S. markets will provide.

Once the next leg of bear market in global stock markets completes, Japan may actually provide an interesting long-term investment play from the bullish side. After all, Japan is only a few months away from having a 20 YEAR STOCK BEAR MARKET. Here's a 30 year monthly chart of the Nikkei ($NIKK) to show this secular bear market in all its ugly glory:

And, true to form, I must mention how Japanese investors could have avoided the pain of the last 20 years with a time-tested remedy: Gold. Here's a 30 year monthly ratio chart of the price of Gold in U.S. Dollar terms divided by the Nikkei Index (i.e. $GOLD:$NIKK):

We'll find out shortly if Asian fireworks are just what it takes to wake the stock bear from its slumber.